Euro: Real-time rates against multiple currencies

According to the latest reports, the Euro is the second most traded currency after the US dollar. This is the widely recognised currency among most members of the European Union.

Nowadays, forex trading has become a source of income for many people. For others, it has become a full-time career, especially if you are conversant with financial matters.

Also, forex trading is worth giving a shot if you are good at strategising and risk management. Therefore, if you are or plan to begin with forex trading, consider trading with the euro to maximize your earnings with a widely followed currency.

Here we discuss more about the Euro; where you can trade it, which other currencies the euro is traded against and how this currency is seen internationally. We also give real-time rates for Euro against the USD, EUR vs AUD, EUR vs CAD and EUR vs JPY. Learn more about the activity for the EUR, when trading is most intensive and much more.

EUR/SEK

EUR/USD

EUR/GBP

EUR/AUD

EUR/NOK

EUR/JPY

Table of Contents: Overview

- 1 What Does the Live Rates for EUR Mean?

- 2 When is it most activity for EUR trading?

- 3 Which countries got the Euro?

- 4 Trading with the Euro: Factors to Consider

- 5 Interesting Facts About the EUR

- 6 How is the Euro Viewed Internationally?

- 7 When is the Best Time to Trade The EUR

- 8 Outlook for the Euro in 2022 and Beyond

- 9 How do you trade the Euro?

What Does the Live Rates for EUR Mean?

Live exchange rates refer to the exact currency quotations that forex brokers and banks provide the forex traders with at a particular time. The following are the meanings of the EUR live rates against various currencies.

EUR/USD

EUR/USD means trading euro against the US dollar. It simply shows the number of US dollars that you need to purchase a euro. For instance, if the rate for trading the pair is at 1.5, it implies that you need 1.5 US dollars to buy one euro.

This has become the most traded currency pair globally since the largest economies in the world use these currencies. The trading rates for this pair are affected mainly by government policies and the factors that affect demand and supply in the currency market for these particular currencies.

2. EUR/GBP

This means trading the euro against the British sterling pound. It indicates that the GBP is the quote currency, and the euro is the base currency. Therefore, the pair represents the number of sterling pounds you need to purchase a euro. The EUR/GBP has maintained a very steady price action compared to other currency pairings due to the smooth transfer of capital between the countries.

The major bodies that affect the trading of this pair include the UK parliament, Bank of England, and European Central Bank.

3. EUR/AUD

This pair refers to trading euro against the Australian dollar. In this pair, the EUR is the base currency while the AUD is the quote currency. Therefore, the pricing of this pair will help you know the value of the Australian dollar.

4. EUR/JPY

The EUR/JPY is among the most commonly traded pairs in the forex trading market. It means trading the euro against the Japanese Yen. The EUR is the base currency, whereas the JPY is the quote currency. Historically, the JPY is a low-yielding currency. As a result, most traders borrow the Yen at a lower price when the market is relatively stable and purchase higher-yielding currencies like the USD or the EUR.

5. EUR/SEK

This means trading the euro against the Swedish Krona. Although Sweden is found in the eurozone, it is yet to adopt the Euro currency. This is due to a loophole in the 1995 accession agreement, which enabled them to continue using their Krona. The Krona is currently benefiting from this crisis since most investors are worried about the survival of this single bloc currency. As a result, this trading pair is quite unstable.

When is it most activity for EUR trading?

EUR constantly trades from Sunday evening to Friday afternoon, offering you an opportunity to make a significant profit. However, market volatility varies every 24 hours, and it mainly affects the less popular currency pairs. But when is the best time to trade the EUR?

One of the major factors that affect the euro trading time is the economic data release. Therefore, planning your trade ahead of these releases can either be beneficial or risky. However, not all releases can affect trading. The most popular release that impacts the currency pairings is the US economic release which happens between 8.30 a.m. to 10 a.m. ET. This is because the EUR/US currency pairing is the most popular in forex trading.

The eurozone economic releases usually happen at 2 a.m. ET. One hour before and after the release are critical for trading the euro. This is because these releases will affect at least three of the most popular euro currency pairings. It also runs concurrently with the start of the US trading day, attracting considerable trade from all sides of the Atlantic.

Therefore, the ideal time for Euro trading is between midnight and noon when the European and American markets are active. Also, consider carrying out your trade during important economic announcements, which usually happen at 8.30 a.m., 1.30 a.m., 10 a.m., and 2 a.m. US ET.

Which countries got the Euro?

19 EU countries use the Euro as their official currency. It took more than 40 years of preparations for the Euro to get rid of and it was not introduced until 2002. Today, Belgium, Cyprus, Estonia, Finland, France, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, Spain, Germany and Austria use the Euro as the only official currency.

The countries with the Euro as their currency are commonly referred to as the Euro countries, and are also the nations that together make up the European Monetary Union. The European Central Bank and the European Commission are responsible for the value and economic stability of the Euro. It is also these institutions that have developed the criteria that must be met for membership of the European Monetary Union (EMU) and that allow the conversion to EUR as the official currency.

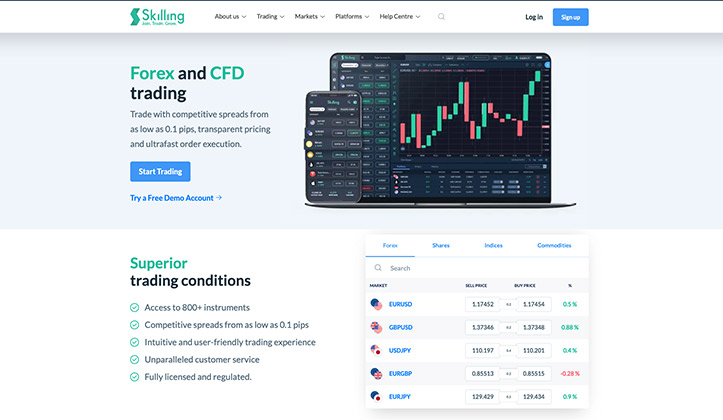

Rating: 9.56/10

Minimum deposit: 100 GBP

Description: Trade Euro with Skilling. Multiple crosses against the euro with tight spread and a super user friendly platform. Try a Skilling demo account now!

Risk warning: 76% of retail investor accounts lose money.

Trading with the Euro: Factors to Consider

Before you start a trade, there are various factors you should consider to avoid making losses. Nevertheless, the euro is relatively stable. It rarely moves more than 1% up or down against its major counterparts in a given day. Here are some of the major factors to consider before you start any trade with the euro.

Risk to Reward Ratio

This refers to the proportion of currency you are likely to risk before you achieve your goals. Always go for a trade with a high risk-reward ratio. However, you need to be comfortable with it. According to research, the best risk to reward ratio is 1:3.

The Relationship Between Currency Pairs and The Market

Another important consideration when determining whether or not to start trade is the relationship between currency pairings and markets. Taking note of the relationship between currency pairs will help you avoid the dangers of linked positions. On the other hand, paying attention to Intermarket correlations will give you clues about how the present trend will continue.

Experts Opinion

Some people have enough experience when it comes to forex trading. Therefore, they know when it is safe to start trading and when it is not. Therefore, before you open any trade, it is advisable to seek their advice. Nowadays, it is pretty simple to get advice from these experts. You can visit any business website and read or listen.

Future Releases

When it comes to forex trading, it is impossible to ignore the effects of the upcoming releases. If the possible transaction is based on a quiet market with a consistent trend, an unforeseen release might sabotage the deal by creating instability. Similarly, if you predict a forthcoming macro report to drive the currency pair in the desired direction, you may be more inclined to start trading.

Personalities and Institutions

The central bank of the US and Europe significantly affect the currency pairs. These institutions control the interest rates, regulate the monetary policy and money supply. This, in turn, affects the strength and weaknesses of all currencies.

Also, the markets usually react to the speeches of the chairman and the president of the central bank. This increases the volatility of the forex trading market. In ForexTrading’s school, you’ll learn more about 50+ factors that may affect exchange rates.

Interesting Facts About the EUR

The euro was created on January 1, 1999, after lengthy EU discussions; since the 1960s. The process of making the euro a legal tender took time due to opposition from the United Kingdom. However, things became easier after the Maastricht Treaty went into force in 1993.

The currency was essentially created in 1999, but the notes; and coins started circulating; in 2002. It then gradually displaced the national currency of these countries.

How is the Euro Viewed Internationally?

Despite the Euros’ modest age of just under 20 years, the single market currency is still the world’s second largest and second most traded forex pair. Only US dollars are traded in larger volumes. The euro is also the world’s second largest reserve currency, and can thus be considered to have achieved quite great success in its capacity as a comparatively very young currency. The currency pair EUR/USD is the pair that is traded by far the most in the international forex market, both among professionals investors and private forex traders. The euro is generally highly valued by most of the world, and is generally considered to be a stable and secure currency – largely due to its size and spread.

However, the Euro – or perhaps especially the Euro cooperation – has encountered a number of obstacles over the years, which at times have caused confidence in the euro in general and the European Monetary Union in particular to fall sharply. Several European countries, including Greece, Spain and Portugal, were hit by a massive economic crisis around 2009. A crisis that lasted for many years to come, and eventually spread to Italy, Cyprus and Ireland. Measures were put in place, both by the IMF and the European Commission in consultation with the respective finance ministers of the Euro-Nations, and an economic stabilization mechanism was set up with the aim of restoring and ensuring financial stability in the euro area. The situation has since stabilised to some extent, and although the crisis – which began in a heavily indebted Greece – had nothing to do with the Euro as such, the single monetary union naturally created a domino effect that became highly felt in many Euro- the area.

When is the Best Time to Trade The EUR

EUR constantly trades from Sunday evening to Friday afternoon, offering you an opportunity to make a significant profit. However, market volatility varies every 24 hours, and it mainly affects the less popular currency pairs.

One of the major factors that affect the euro trading time is the economic data release. Therefore, planning your trade ahead of these releases can either be beneficial or risky. However, not all releases can affect trading. The most popular release that impacts the currency pairings is the US economic release which happens between 8.30 a.m. to 10 a.m. ET. This is because the EUR/US currency pairing is the most popular in forex trading.

The eurozone economic releases usually happen at 2 a.m. ET. One hour before and after the release are critical for trading the euro. This is because these releases will affect at least three of the most popular euro currency pairings. It also runs concurrently with the start of the US trading day, attracting considerable trade from all sides of the Atlantic.

Therefore, the ideal time for Euro trading is between midnight and noon when the European and American markets are active. Also, consider carrying out your trade during important economic announcements, which usually happen at 8.30 a.m., 1.30 a.m., 10 a.m., and 2 a.m. US ET.

Outlook for the Euro in 2022 and Beyond

From 2022 onwards, the amount of countries holding the euro as a reserve currency is expected to rise. The factors that majorly affect the euro trading include the confidence and sentiment report, inflation and prices, GDP and economic growth, the balance of payment, and monetary policy. The most traded EURO-pairs in 2022 is expected to be EUR/USD, GBP/EUR and EUR/JPY.

How do you trade the Euro?

Currency trading with Euro is offered at all major forex brokers. If you trade the major pair EUR/USD, you are usually offered a very favourable spread because there is always good liquidity. However, the Euro is obviously also traded very frequently with the British pound. Below are three of our favourites for Euro trading with CFD.

+Skilling: A Scandinavian broker that is sponsor for Aston Villa. They stand out with an incredible user friendly platform. Try Skilling today!

+eToro: The favourite for copy trading.

+Capital: Amazing platform and flexible leverage. Try Capital now!

2 things you didn’t know about the euro

It is made from Nordic gold! Euro coins are made from Nordic gold, which has highly secure machine-readable outlines that prohibit the manufacture and circulation of counterfeit euros. Nordic Gold does not contain any gold and is made of aluminium, zinc, tin, and copper. However, it has little similarity to genuine gold in terms of colour or weight.

It is used for Iranian oil transactions – Despite Iran having its currency, the country prefers to use the euro for all international transactions, particularly oil. Due to its long-standing enmity with the US, Iran has converted all its dollar-denominated assets to the euro. While Iran is not a European ally, it does have a lower level of antagonism toward them.