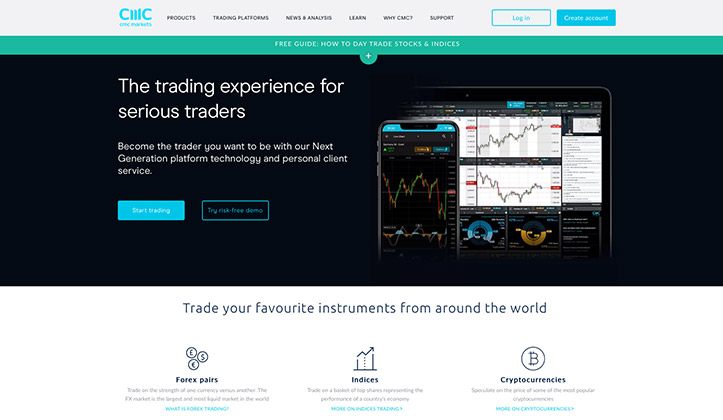

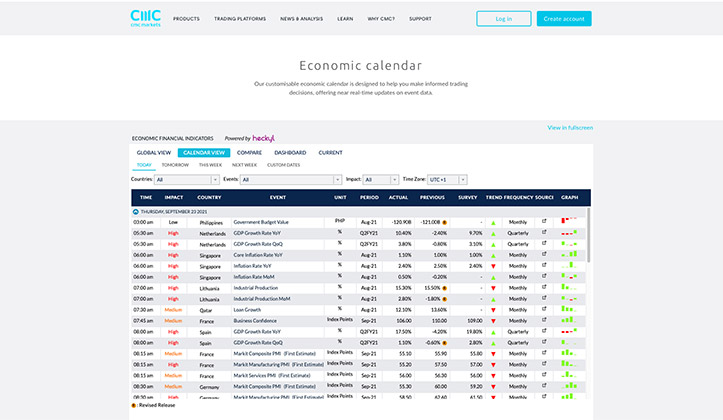

CMC Markets is a publicly traded company under the ticker CMCX that was founded in 1989. In the UK, it is recognized as one the most successful forex broker, meeting the advanced needs of most online brokerage users. Today, it is listed among the top brokers in the London Stock Exchange market. CMC restricts its users to European countries, thereby excluding traders in the US.CMCs trading platform, Next Generation has over 10,000 tradable instruments and offers its users terrific experience through advanced tools and market resources. Its MetaTrader 4 platform is equally efficient although it offers about 62 symbols only. Give CMC Markets a try today, you will not regret.CMC is a reliable broker that offers excellent customer support. It has a user-friendly trading platform and it allows you to trade over 70 different types of financial instruments on the live markets from your desktop or mobile device connected to the internet. You can contact us via; live chat, phone or email.

-

Min. deposit

Unlimited

-

Platforms

4

-

Founded

1989

-

Licenses

1

-

Country

Germany

-

Commodities/Crypto

Yes, Yes

-

Stocks

Yes

-

Support

Yes

-

Deposit currency

GBP

Overview

Registration and KYC

Registration and KYC

Required documents: While opening an account, CMC Markets will ask for supporting documents to verify your identity. The main Know Your Customer" requirements include:

Proof of identity may include a passport, a valid ID, or a driving licence.

Proof of address this should be a proof of the current residential address. If not available, you may present the following:

Utility bill.

Insurance letter.

Letter from any government institution.

Credit card or bank statement.

Then you have a deposit guarantee of up to 50 000 GBP, not bad.

Leverage

Leverage

Costs

Costs

Payment Methods

Payment Methods

Benefits at CMC Markets

Benefits at CMC Markets

+ CMC Markets offer some of the lowest commissions on currency trading.

+ They are one of the few brokers that offer negative balance protection.

+ CMC Markets provide a wide array of tools and features such as trading alerts etc.

+ Take part in 300 markets in stocks, ETFs, and commodities.

+ It is regulated by the Financial Conduct Authority (FCA).

+ Segregated client accounts enhance security.

Drawback at CMC Markets

Drawback at CMC Markets

- Their customer service could be even slightly quicker.

- You cannot purchase physical metals such as gold or silver through this broker.

- Has a complex account verification process.

- Charges inactivity fee.- Does not allow access among U.S clients.

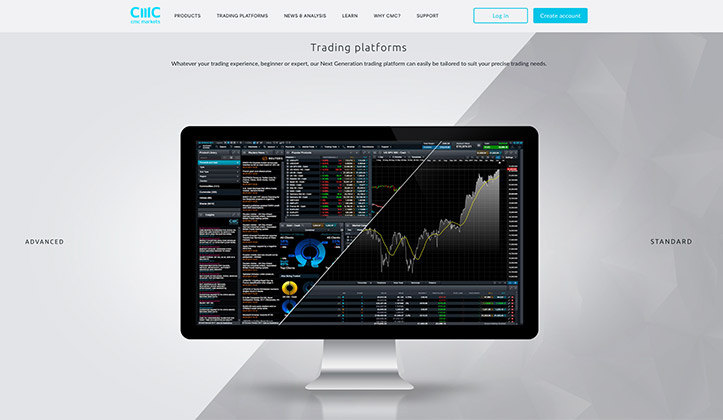

Platforms

Platforms

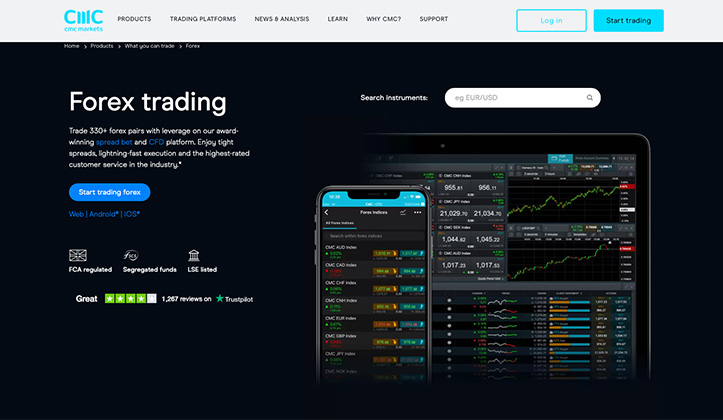

CMC Markets or Currency Management Corporation Markets as they also are called, has two popular trading platforms:

CMC Markets or Currency Management Corporation Markets as they also are called, has two popular trading platforms: MT4

The MetaTrader 4 (MT4) platform is one of the worlds most popular trading platforms in the forex market. MT4 does not require any minimum deposit as users can open their account for free. It has more than 30 years of existence in the industry and has extensive risk management and educational tools. MT4 is also loved by users due to its award-winning support. At the comfort of your home, you can access the MT4 app using an Android, iPad, or iPhone or simply trade from the comfort of your computer.

NextGeneration

CMC Markets NextGeneration platform is reliable and fast with impressive tools and features for trading. The platform has over 115 technical indicators, 70 patterns, and 40 drawing tools when it comes to charting. An interesting aspect of the charting pereince is the Breakout and Emerging Patterns tools that enable traders to adjust the stock data from a single minute chart to a monthly chart.Next Generation is recommended for traders that prefer a simplified interface. It has an easy-to-use and streamlined layout with limited features and offers the most commonly used tools to execute trades quickly.3. IOSThis is a mobile app that allows traders to trade on the go. You can access your account and place trades via this application as long as you have an internet connection. The platform also has valuable features for technical analysis such as charts, trend indicators, etc.4. Android TabletThis is a tablet app that works on Android tablets with the operating system version of KitKat or later. This platform acts as a separate trading terminal and can be used to view price quotes, trade forex currency pairs, stocks, and CFDs, etc.