Buy Ethereum? Live Rates & Top List

Crypto traders and investors gets more interesting with Ethereum; people talk about it and invest in it too – sometimes as an alternative to forex trading. In cryptocurrencies, volatility is how much a financial asset will vary over time.

Table of Contents: Overview

- 1 Ethereum Live rates right now

- 2 Top list over the 5 best sites to buy Ethereum

- 3 What is the difference between Ethereum and Bitcoin?

- 4 What is Ethereum?

- 5 Advantages of Ethereum

- 6 Disadvantages of Ethereum

- 7 Scalability and Performance

- 8 Tokenization

- 9 Network Size

- 10 How can you Trade ETH?

- 11 How Does Ethereum Mining Work?

Ethereum Live rates right now

ETH/USD

ETH/BTC

If investors notice that an asset is more volatile, they will refrain from it in any way possible through holding it or hedging. Volatility has adverse effects such as increasing the price of hedging, which contributes majorly to merchant prices. The volatility of ethereum affects it directly. If it decreases its costs, the cost of converting into and out of ethereum will decrease too. Volatility is currently a newer class asset of being capable of fluctuating in shorter periods.

Top list over the 5 best sites to buy Ethereum

Rating: 9.78/10

Minimum deposit: 50 GBP

Description: Get inspiration from the markets’ best traders for free! Discover the worlds’ best social forex trading site.

Risk warning: 68% of private investors lose money when they trade CFDs with eToro.

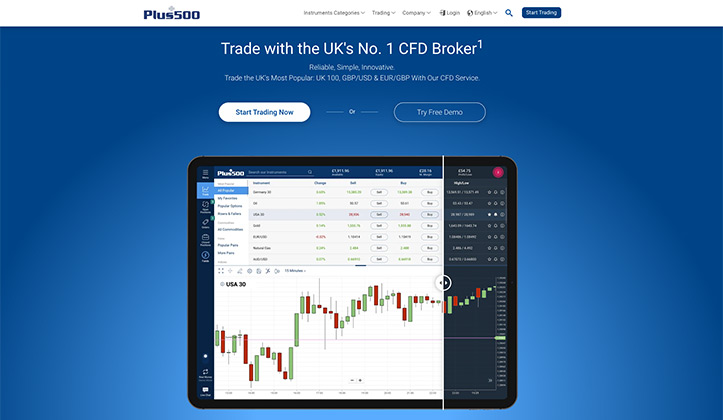

Rating: 9.56/10

Minimum deposit: 100 GBP

Description: Trading. Easily. Forex trading with rapid execution. Perfect for British traders.

Risk warning: 63% of retail investor accounts lose money.

Minimum deposit: Unlimited

Description: Next generation of traders. Trade your own way. Full flexibility. Since 1989. An online trading site to trust.

Risk warning: 69% of all non-professional clients lose money on CFD-trading with this broker.

Rating: 9.67/10

Minimum deposit: 250 GBP

Description: 1-click trading with 4079+ instruments.

Risk warning: 75.26% of retail investor accounts lose money when trading with Capital.

Minimum deposit: 100

Description: Reliable currency trading from a listed company.

Risk warning: 72% of CFD-accounts for non-professional customers loose money.

What is the difference between Ethereum and Bitcoin?

The biggest difference between ETH and BTC is that Ethereum is built to handle much more than transactions of digital currencies. The blockchain on which ETH is built allows, among other things, transfers of so-called “smart contracts”. Smart Contracts is simply explained as a term for digital codes that can handle money transfers, web-based content in the form of digital apps and other information that has nothing to do with cryptocurrency, property such as land, jewels or homes, shares and everything else. physical value.

All blockchains are built to read coding, but most blockchains have major limitations. Ethereum is different, it allows unhindered transmission of codes so you can code just about anything – not just digital money.

What is Ethereum?

It is a blockchain community with its cryptocurrency known as Ether [ETH] or ethereum. It also possesses its programming language known as Solidity.

Ethereum is an improvement on the blockchain that created Bitcoin. It is one of the largest cryptocurrencies in the entire industry. Ethereum was created in 2015 and had some technical differences that separated the currency from other cryptocurrencies (read more about this below).

The idea that the creator Vitalik Buterin had with Ethereum was to take cryptocurrencies to the next level by fixing some fundamental problems that Bitcoin was known for. Long waiting times for confirmations are one and the problem with the centralization phenomenon that the minin process created.

After the launch at the end of July 2015, it took a while for the currency to be accepted in the industry, it went up and down a bit before ETH took off and began to rise in value like a rocket to the skies. On June 13, 2017, the value stood at $ 388 and reached its highest listing ever, making Ethereum one of the most expensive cryptocurrencies in the industry.

As the use of cryptocurrencies is not as widespread yet, Ethereum is not as useful as BTC in terms of payment options, but it is at least as valuable in terms of security and value preservation as investment options. With that said, there are already many companies that accept ETH as a payment alternative and there will be more.

The benefits of ETH are just like any other cryptocurrency – they are free from a central authority and third parties, the transactions are lightning fast, are not affected by geographical boundaries and are available in transparent accounts.

Advantages of Ethereum

Ethereum has proven to be more extensible and better than Bitcoin’s payment method in blockchain technology. With a blockchain system, participants can conduct transactions without needing the services of an intermediary. Participants are also sure that all their transactions are secure and immutable.

Disadvantages of Ethereum

The main disadvantage with ETH is undoubtedly the high transaction (gas) fees. One standard transaction often cost over 70 GBP to complete.

You can also say that there is a high risk-reward investment. This means that if its value depreciates, its participants are bound to lose a considerable amount of their investment. Even though Ethereum has amazing performance and benefits, it still has some disadvantages. Below are some of the cons of ethereum.

With blockchain software in Ethereum, transactions automatically execute because agreements are inclusive of the code. Ethereum is vital in making payment settlements and supply chains, law, real estate, and other sectors. Ethereum is popular for both private and public sectors today.

Scalability and Performance

The performance of ethereum largely depends on the network configuration. Underproof by Authority consensus, ethereum can conduct hundreds of transactions per second, thus outperforming software such as the public mainnet.

various protocol levels provide opportunities to ethereum so that it can increase its competence in the coming future. These protocol levels include layer two scaling solutions like plasma and sharding.

Tokenization

Any asset under registration using the digital format can be tokenized by any business. When a business tokenizes its assets, it gains benefits such as; the ability to increase its products, thus expanding its sphere, discovering and unlocking new incentives, and finally divide monolithic assets.

Quick Deployment

It becomes easier and faster for businesses to deploy and manage blockchain networks. It is because; there are platforms such as Hyperledger Besu that make this possible. Were it not for it, most enterprises would have to code a blockchain implementation from scratch.

Data Coordination

With a decentralized system, ethereum can relay information to its participants so that they do not depend on a central system. Therefore, they can easily manage the system and all transactions too.

Network Size

If you consider the network most businesses use, it contains less than ten nodes and lacks a viable network. As for ethereum, this is not the case. The ethereum network contains over 100 nodes, thus enabling it to have many users. Network size is vital to any business as it will outgrow fewer nodes someday.

Secure Transactions

By creating private consortia, most enterprises can achieve privacy when using ethereum. Any participant on the network cannot be able to see any transaction. Only relevant parties have the clearance of gaining access to private data, which is usually encrypted.

Investing in Ethereum is Risky

Just like any other cryptocurrency, it is riskier to invest in ethereum. Be sure that you understand how the system works before you can invest in any kind. Since it is highly volatile, you will get very high gains, and when it comes to losses, you will suffer plenty of it. Some investors may be at a disadvantage since the price of ethereum fluctuates from time to time. The fees too suffer the same fate, thus making it more troublesome to investors.

Scaling Issues

Ethereum serves a ledger unlike other cryptocurrencies like Bitcoins that serve only one purpose. This, in turn, creates room for more flaws and breakdowns. It also makes it vulnerable to hacks.

It Uses a Difficult Programing Language

Ethereum’s native language is difficult even if it turning completely to using a programming language that is more like C++, Java and Python. It is also hard to find beginner-friendly lessons on Ethereum.

How to Evaluate if Buying ETH at the Right Time

You will notice that it is hard to time the market with cryptocurrencies as they are a much more volatile investment. It will be challenging when you try to find the perfect time to buy ETH. You can try going through the realtime ETH price since ETH live rates are available on the internet.

It is wiser to wait before purchasing ETH because you may buy when the prices are low, but after a short while, the prices may go lower and you shall realise that you invested early. Keep an eye on the realtime price for ETH because if you wait for too long, the prices may shoot.

How can you Trade ETH?

Most people will claim that they are trading ethereum but what they are doing is trading its tokens. To trade ethereum, you will need to go through certain systematic steps. They include the following:

You will need to open an account first before anything else. It would be best if you came up with a trading plan that is good enough. With a trading plan, you will be able to know when to open and close your positions. It will also help manage your emotions on the market. To come up with a good trading plan, you need to consider this;

Your aim then set your goals on a daily, weekly and monthly basis

Have vast knowledge on the markets you want to trade in

On each trade you choose, set an amount that you are willing to risk

Calculate your risk-reward ratio

Do a Research about Live Ethereum Rate

Take time to go through all the latest development in ether and ethereum before you can engage in it. You will need to conduct a technical analysis by going through ethereum’s chart and study its price movement such as;

Realtime price

Knowledge of Realtime price for ethereum ensures that you get information on live ethereum rates. You will then be able to predict its direction with ease.

Place of Trade

It is better to place your trade on IG. You will increase your liquidity at the time you will be opening your position. It is beneficial because your position will be at your desired price. You can trade in the opposite direction if you want to close your position.

What is ETH 2.0?

Ethereum 2.0 is an upgrade to ethereum in different levels. It increases ethereum’s capacity for various transactions, makes price reductions and sustains the network.

How Does Ethereum Mining Work?

In ethereum, miming is the process of solving complex mathematical problems. Through mining, there is the creation of new ether tokens. All you need is to order a miner online who will do the job for you. You will have to choose a mode of payment, be it with cryptos or fiat. After that, you will need to be patient so that team installs it.

after that, cryptos will directly flow into your wallet. If you are a single miner, you do not stand the chance of winning the hash rate race, which is usually very competitive. Be sure to select the best mining pool that will provide the best mining experience for you.