Silver trading: Top 6 best sites for XAG

Trading with silver, the white metal with the ticker XAG, has a famous reputation for its use in jewelry and coins, but today silver is used mainly industrially and for speculation.

Forex Trading has selected the 6 top sites that offer silver trading, in the form of CFDs, ETFs or physical silver. Here, ForexTrading.uk will go through where you can trade with silver. Next, important properties of silver, its use in electronics, where silver comes from, the historical relationship between gold and silver and what influences the price of silver are discussed. Many ask themselves if silver will repeat the price development similar to the previous business cycle and if a commodity supercycle is on the way? For silver trading through a British site, the top list below is recommended.

Top list over UK’s 6 best sites for silver trading with CFDs

At these commodity CFD brokers you can trade silver at its best; easiest and most affordable ways. .

| Rank | Broker | Rating | Min. Deposit | Offering | Review |

|---|---|---|---|---|---|

| 1 |

Skilling: “Trading. Easily. All types of trading in silver, gold, other commodities, stocks and currencies from one place. ” |

||||

| 2 |

CMC Markets: “Buy silver and other commodities from a great commodity CFD broker with a fantastic platform.” |

||||

| 3 |

Capital: “Trade commodities like silver with CFDs a little smarter. You get help from AI from the trading site Capital.” |

||||

| 4 |

eToro: “Extensive range of commodities for easy & social CFD trading online. Trade gold and silver with or without leverage. You choose yourself, very simple.” |

||||

| 5 |

AvaTrade: “Become a winner in the commodity market with gold or silver trading. Do as Manchester City, run AvaTrade.” |

||||

| 6 |

Plus 500: “Reliable, simple & innovative commodity CFD trading with STP execution.” |

Table of Contents: Overview

- 1 Top list over UK’s 6 best sites for silver trading with CFDs

- 1.0.1 Why is silver considered a precious metal?

- 1.0.2 How can silver be formed?

- 1.0.3 Use of silver in electronics

- 1.0.4 Use of silver in energy

- 1.0.5 Use of silver in soldering

- 1.0.6 Use of silver in chemical production

- 1.0.7 Use of silver in coins and bars

- 1.0.8 Silvers usage as a currency

- 1.0.9 Use of silver in jewelry and cutlery

- 1.0.10 Use of silver in the photo industry

- 1.0.11 Use of silver in medicine

- 1.0.12 Use of silver in mirrors and glass

- 1.0.13 Usage of silver in engine

- 1.0.14 Use of silver in medals

- 1.0.15 Use of silver for water, food, hygiene

- 1.0.16 Other uses for silver

- 1.0.17 The availability of silver: The difficulty of obtaining physical silver

- 1.0.18 Reddit’s group’s failed attempt to increase the price of silver

- 1.0.19 Some of the issues that Reddit encountered were the following

- 1.0.20 Why is it wise to care about the gold-to-silver ratio?

- 1.0.21 Why is it wise to care about the gold-to-silver ratio?

- 1.0.22 Historical: This is what the gold-to-silver ration looked like

- 1.0.23 What does this mean for the future?

- 1.0.24 What affects the silver price?

- 1.0.25 Industrial demand

- 1.0.26 Medical demand

- 1.0.27 Investment demand

- 1.0.28 Political climate

- 1.0.29 Short and long term levels for silver?

- 1.0.30 Weak dollars provide support for silver

Why is silver considered a precious metal?

While trading gold is considered a “safe haven”, silver is significantly more volatile and are seen as a leverage on gold by some speculator.

How can silver be formed?

Because it is more available, silver is much cheaper than gold. Silver can be ground into powder, turned into paste, shaved into flakes, converted into a salt, alloyed with other metals, flattened into printable sheets, drawn into threads, suspended as colloid or even used as a catalyst. These qualities ensure that silver will continue to shine in the industrial arena, while its long history in coins and jewelery will maintain its status as a symbol of wealth and prestige.

Use of silver in North America: The US Geological Survey has presented the amount of silver used in the United States by user category. The category “Other” accounts for almost a quarter of the silver used and is fragmented into hundreds of different uses. Many of these are described below. Whether it is mobile phones, solar panels or important parts in electric cars, new innovations are always emerging to take advantage of the silver’s unique properties.

Use of silver in electronics

The main use of silver in industry is in electronics. In the U.S, this area of use accounts for 35%. Silver’s unsurpassed thermal and electrical conductivity among metals means that it can not be easily replaced with cheaper materials.

For example, small amounts of silver are used as connectors in electrical switches: connect the connectors and the switch is on; separate them and the power switch is off. Whether you turn on bedroom lighting with a conventional switch or turn on a microwave oven using a diaphragm switch, the result is the same: the power can only pass through when the connectors are put together. Cars are full of connectors that control electronic functions, and so are appliances for consumers. Switches for industrial strength also use silver.

How does silver get from the earth to these electronic devices? Silver comes from silver mines or from lead and zinc mines from which silver is a by-product. Melting and refining remove silver from the ore. Then silver is usually formed into rods or grains. Electronics require silver with the highest purity: 99.99% purity, also known as a fineness of 999.9.

Dissolution of pure silver in nitric acid gives silver nitrate, which can be formed into powder or flakes. This material can in turn be made in contacts or silver paste, as conductive paste made with a silver-palladium alloy.

Silver paste has many uses, such as the mentioned diaphragm switch and the defrost in the back of many cars. In electronics, circuit paths, as well as passive components called multilayer ceramic capacitors (MLCCs), are dependent on silver paste. One of the fastest growing uses of silver paste is in solar cells for the production of solar energy.

Nanosilver, silver with an extremely small particle size (1-100 nanometers, ie 1-100 millionths of a meter), provides a new frontier for technological innovation that requires much smaller amounts of silver to get the job done. Printed electronics work with nanosilver conductive inks. An example of a printed electronics is the electrode in a supercapacitor, which can be charged and discharged repeatedly and quickly. Regenerative refraction is a vehicle innovation that makes it possible to store the kinetic energy of a slow vehicle in a supercapacitor for reuse. Radio Frequency Identification (RFID) tags offer another powerful application of printed electronics. These tags are better than barcodes for tracking layers because they store more information and can be read from a greater distance, even without a direct field of view.

Silver also has its place in consumer electronics. Your plasma TV can rely on silver for more than just the on / off switch if it contains a silver electrode that aims to provide a higher picture quality. LEDs also use silver electrodes to produce low-level, energy-efficient light. Meanwhile, the DVDs and CDs you play probably have a thin silver recording layer.

Another electronic application of silver is found in batteries that use silver oxide or silver alloys. These lightweight, high-capacity batteries work better at high temperatures than other batteries. Silver oxide is used in button batteries that operate cameras and watches, as well as in space and defense applications. Silver-zinc batteries offer an alternative to lithium batteries for laptops and electric cars.

At the forefront of technology are superconductors. Silver is not a superconductor, but when connected to one, they can both together transmit electricity even faster than the superconductor alone. At very low temperatures, superconductors carry electricity with little or no electrical resistance. They can be used to generate magnetic energy to turn motors or drive magnetic levitation trains.

The countless applications of silver in electronics provide an eye-opening view of how one of the most famous metals in history has become a material of the future. Partly because of its unique property of having the highest thermal and electrical conductivity of all metals, silver is often a must than other, cheaper materials.

Use of silver in energy

As previously mentioned, silver paste is used to make solar panels. Silver paste connectors printed on solar cells capture and carry electric current. This current is produced when solar energy affects the semiconductor layer of the cell. Solar cells are one of the fastest growing uses of silver.

Silver’s reflectivity gives it a different role in solar energy. It reflects solar energy in collectors that use salts to generate electricity.

Nuclear energy also uses silver. The white metal is often used in control rods to capture neutrons and reduce the fission rate in nuclear reactors. Inserting the guide rods into the core slows the reaction, while removing it faster.

Use of silver in soldering

Soldering and brazing use the high tensile strength and toughness of the silver to create joints between two pieces of metal. Soldering takes place at temperatures above 600 Celsius, while soldering takes place at temperatures below 600C. Silver scrap can be used for soldering and soldering as these processes do not require much pure silver. Soldering provide tight joints for everything from heating and air conditioning openings to plumbing. Silver’s antibacterial properties and non-toxicity to humans make it an excellent substitute for lead-based bonds between water pipes.

Use of silver in chemical production

Silver acts as a catalyst to produce two important chemicals: ethylene oxide and formaldehyde. Ethylene oxide is used to produce molded plastics, such as plastic handles, and flexible plastics, such as polyester. It is also an important ingredient in antifreeze. Formaldehyde is used to make solid plastics and resins and as a protective coating. It is also used as a disinfectant and embalming agent. As a catalyst, silver increases the reaction rate without getting used to it.

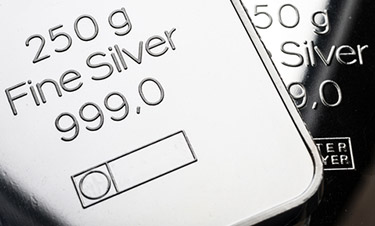

Use of silver in coins and bars

Silver has traditionally been used, with gold, as the metal used in coins, which can be seen on sites such as the Silver Club or the Royal Mint. As late as 1942, Swedish 1 kronor consisted of 80% silver and each coin weighed 7.5 grams, according to the Silver Club.

Even today, just over 25% of all silver use goes to coins, silver medals and ingots. As a precious metal, silver is rare and valuable, making it a convenient asset. In the past, people accumulated their wealth in the form of silver coins; today they invest in the investment class silver. The fact that silver does not corrode and only melts at a relatively high temperature means that it can last, and the fact that it has a high gloss makes it attractive. Its agility makes silver a good choice for the design and embossing of local currency. The world oldest currency still in circulation, British pounds, used silver coins until it was replaced by cupro-nickel in the middle of the 20th century. After the 1960s, it was rare to see any coins in UK made in silver since more or less all were out of circulation.

Silvers usage as a currency

In greater abundance, and thus cheaper than trading in gold, silver has been used more commonly as a currency. Silver was mined and used in trade several thousand years BC. and was first minted in silver coins in the Mediterranean many hundreds of years BC. Until the 20th century, many countries used a silver or gold standard that backed up the value of currency with the presence of gold or silver in the treasury. Today, countries use cheaper metals, such as copper and nickel, to produce coins, and they use fiat currency, where government regulation governs value instead of a gold or silver standard.

Still, silver retains its value as a commodity. Many individuals choose to invest in silver through financial instruments, such as stocks and mutual funds, or by actually buying and storing 99.9% pure silver ingots, coins or medallions. Countries sometimes produce silver coins, which they sell to buyers at a price that exceeds the value of the silver used to make the coin.

Use of silver in jewelry and cutlery

Jewelry and cutlery are two other traditional uses for silver that account for around 6% of use in the United States.

Flexibility, reflectivity and gloss make silver a beautiful choice. Because it is so soft, silver must be alloyed with base metals, such as copper, as in the case of sterling silver (92.5% silver, 7.5% copper). Although it resists oxidation and corrosion, silver can stain, but with a little polish it can shine for a lifetime. Because it is cheaper than gold, silver is a popular choice for jewelry and a standard for fine dining. Silver-plated base metals offer a cheaper alternative to silver.

Silver plates and plates can be included with cutlery, and these can often be ornate works of art. For example, Paul Revere (1734-1818), known to most for his midnight walk at the beginning of the American Revolution, was a silversmith in the trade, and some of his artwork is still on display at the Boston Museum of Fine Arts.

Use of silver in the photo industry

Photography had been one of the main industrial uses of silver until the recent advent of digital media. Traditional film photography is based on the light sensitivity of silver halide crystals present in the film. When the film is exposed to light, the silver halide crystals change to record a latent image that can be developed into a photograph. The accuracy of this process makes it useful for non-digital consumer photography, film and X-ray.

The silver used in film photography should not be confused with the cinema’s “silver screen”. This phrase does not refer to silver in the film itself but to the silver lens screen on which early films were projected.

Use of silver in medicine

Silver ions act as a catalyst by absorbing oxygen, which kills bacteria by interfering with their breathing. This antibiotic property, along with its non-toxicity, has given silver an important role in medicine for thousands of years. Prior to widespread use of antibiotics, silver foil was wrapped around wounds to help them heal, and colloidal silver and silver protein complexes were ingested or applied topically to fight disease. Silver has also been used in eye drops and in dental hygiene to cure and prevent infection.

While silver is not toxic, repeated ingestion of small amounts of silver over time can lead to argyria. In people with this condition, silver builds up in body tissue, giving it a gray-blue appearance when exposed to the sun. In addition, consuming large amounts of silver can have negative effects on the body. For these reasons, doctors discourage the use of colloidal silver and discount claims from some that colloidal silver is a cure for dietary supplements.

Today, the prevalence of antibiotic-resistant superbugs is increasing the demand for silver in hospitals. Small amounts of silver can cover hospital surfaces and medical equipment to prevent the spread of pathogens. Silver in surgical equipment, wound dressings and ointments protect wounds from infection. Silver sulfadiazine is especially useful for victims of burns because it kills bacteria while allowing the skin to grow back. Silver ion treatments can heal bone infections and enable regeneration of damaged tissue.

Use of silver in mirrors and glass

Silver is almost completely reflective when polished. Since the 19th century, mirrors have been made by coating a transparent glass surface with a thin layer of silver, although modern mirrors also use other metals such as aluminum. Many windows in modern buildings are coated with a transparent silver layer that reflects sunlight and keeps the interior cool in the summer. In space, silver-plated tiles protect spacecraft from the sun.

Usage of silver in engine

Engine bearings are dependent on silver. The strongest layer is made of steel that has been galvanized with silver. The high melting point of silver means that it can withstand the high temperature of the engine. Silver also acts as a lubricant to reduce the friction between a ball bearing and its housing. Due to its ability to absorb oxygen, silver is being investigated as a possible substitute for platinum to catalyze the oxidation of materials collected in diesel engine filters.

Use of silver in medals

Due to its status as a precious metal, ranked second only to gold, silver is often used to award second places. The most famous silver prize is the Olympic silver medal for second place. Silver also symbolizes honor, bravery and achievement, which is why many military organizations, employers, clubs and associations use silver or silver-colored awards to honor individuals for their contributions.

Use of silver for water, food, hygiene

The antibacterial properties of silver have been applied for thousands of years, long before the discovery of microbial organisms, as silver containers and coins were known to prevent the destruction of liquids. Today, a silver coating prevents bacterial buildup in carbon-based water filters, while silver ions in water purification systems carry oxygen that oxidizes and kills microbes. Silver copper ions can even replace corrosive chlorine to disinfect pools and tanks.

The antimicrobial properties of silver that make it useful for medicine and water purification are now applied in food and hygiene. Nanosilver coatings are applied to food packaging and refrigerators. And many new consumer products, such as washing machines, clothes and personal hygiene products, take advantage of the benefits of antibacterial silver.

Other uses for silver

Other traditional uses for silver are available. For example, silver is an ingredient in amalgam used to fill cavities, although this approach has been largely replaced by other materials due to the presence of toxic mercury in the amalgam. Silver has also been used to flatten instruments, such as grooves.

Today, silver is used for many new uses. Silver is one of many options to replace toxic chromed copper arsenate as a wood preservative. Nanosilver paints and coatings on paper demonstrate their ability to prevent the spread of bacterial infection. Silver metal glass, produced by rapidly cooling silver, offers durable strength that resists deformation. Silver-based ionic liquids, which are in a liquid state at room temperature, can be used to purify petroleum waste products. Silver in fabric allows touch screen users to keep their gloves on during cold weather.

Silver seems to have as many uses as the human imagination can develop. Traditional silver works, such as jewelry and cutlery, rely on the artists’ creativity. Modern uses depend on the creative feats of researchers and engineers to meet the changing demands of consumers and industries. While some uses are rising and falling, such as the use of silver in photographic film, other uses may continue to grow, such as the growing production of solar cells for solar energy. The unique properties of silver, especially its high thermal and electrical conductivity, its reflectivity and its antibacterial properties make it difficult to replace, as a unique silver ring.

Despite the fact that the American analysis company CPM Group reports that stocks of silver in both New York and London have reached record low levels. It is extremely difficult to get hold of physical silver and the British Royal Mint has sold out just about everything that is not special editions with extra expensive prices.

There are plenty of reports from people who ordered silver and also gold from mints such as Perth Mint, US Mint, Royal Mint, Mint of Poland and have been told that there are long waiting times. In some cases, a customer has been notified that there is a one-year waiting period.

After talks with Michel Rufli, CEO and founder of Nordic Gold Trade, we realize that there is no shortage of silver. Many of these mints mentioned above would rather sell their coins than produce ingots. This is because they earn more on their coins than on conveying ewes. In some cases, these mints have not bought enough silver either as they are waiting for a price correction. This is unlikely to come in April, says CPM Group, which refers to the roll-out of May’s silver futures as a trigger that could drive the silver price up.

The availability of silver: The difficulty of obtaining physical silver

Despite the fact that the American analysis company CPM Group reports that stocks of silver in both New York and London have reached record low levels. It is extremely difficult to get hold of physical silver and the British Royal Mint has sold out just about everything that is not special editions with extra expensive prices.

There are plenty of reports from people who ordered silver and also gold from mints such as Perth Mint, US Mint, Royal Mint, Mint of Poland and have been told that there are long waiting times. In some cases, a customer has been notified that there is a one-year waiting period.

After talks with Michel Rufli, CEO and founder of Nordic Gold Trade, we realize that there is no shortage of silver. Many of these mints mentioned above would rather sell their coins than produce ingots. This is because they earn more on their coins than on conveying ewes. In some cases, these mints have not bought enough silver either as they are waiting for a price correction. This is unlikely to come in April, says CPM Group, which refers to the roll-out of May’s silver futures as a trigger that could drive the silver price up.

Reddit’s group’s failed attempt to increase the price of silver

In early 2021, as GameStop pressed for a crescendo – a playoff game in which the GME stock price would either explode above $ 1,000 or fall like a gray stone – the Reddit army turned its attention to the silver market. The goal of “Reddit’s new target for silver” was to increase the price of silver more than 40 times.

Both the price of silver futures and the exchange-traded fund SLV saw one-day price movements of 10% or more. Various silver mines also rose by 10% or more at the same time as the silver price reached a multi-year peak, before going back to modest levels again.

Some of the issues that Reddit encountered were the following

+There is a lot of silver stored above ground in relation to modest industrial needs, and the presses are likely to hit a wall.

+Unlike the GameStop squeeze, there is no targeted party who may be forced to cover their shorts due to margin calls. When it comes to silver, hedge funds are net in total.

+There is a rumor that J.P. Morgan, the giant American investment bank, has a huge short position that is equivalent to a hidden naked short – but this reputation has no real basis and is literally decades old. If JP Morgan actually had such a short, it should have been blown up with the silver run in 2011.

+If the silver price rises too far beyond its fundamental motivation, too quickly, the silver mines – which by their nature are long silvers that are still in the ground – will be happy to secure future production years by selling futures contracts.

+If the silver mines see their share prices rise, they will be happy to issue new shares to pay for more exploration and production efforts.

+The silver market is related to the much larger copper market on the industrial side and to the gold market on the much larger precious metal side: Both of these will exert gravity if the spread between copper and silver or copper and gold becomes too crap.

+WallStreetBets, the Reddit bulletin board promoting the press, is internally opposed to chasing silver is even a good idea: Some see it as a trap, as it is a way to soak up attention and energy from GME before the GameStop battle is won .

The biggest problem with Reddit Silver Squeeze – when it comes to measuring the likelihood of failure or success beyond a short-lived pop – is that structural mechanics do not work properly.

Why is it wise to care about the gold-to-silver ratio?

For experienced investors, the ratio of gold to silver is one of many indicators used to determine the right (and wrong) time to buy or sell their precious metals. Other factors – including economic uncertainty, inflation and debt – have encouraged millions to invest in gold and silver, and in recent years small-scale investors have begun to climb on board.

Despite this market development, for many, the relationship between gold and silver is still a vague, elusive mystery.

Why is it wise to care about the gold-to-silver ratio?

Good question. First, a simple definition: Basically, the ratio of gold to silver is the amount of silver required to buy an ounce of gold. At the time of writing, the ratio of gold to silver was about 70 to 1.

This means that at the current price it would take 70 ounces of silver to buy 1 ounce of gold.

Although there are countless websites that provide the current relationship, it is relatively painless to calculate on your own.

Simply take the price of gold, divide it by the price of silver and Voilà! You have the relationship gold to silver.

Here is an example of the latest market prices:

$ 1743 (gold price) ÷ $ 25.60 (silver price) = about 70 (gold-to-silver ratio)

Thanks for the info, but what does it really mean?

Investors who trade gold, silver and other precious metals examine the gold-silver ratio as a signal for the right time to buy or sell a particular metal.

When the ratio is high, the general consensus is that silver benefits. This is because silver is relatively inexpensive and relatively inexpensive.

Conversely, a low ratio tends to favor gold and can be a signal that it is a good time to buy the yellow metal. Many large, experienced investors can trade silver for gold when the ratio drops.

Unfortunately, because the ratio of gold to silver varies so wildly, it can be difficult for novice or small-scale investors to read the signals and make a profit.

Usually, the ratio of gold to silver acts as a driving force for diversifying holdings (experienced investors agree that diversity is good). If an investment flops, alternative investments in your portfolio take up the slack – or the losses.

Historical: This is what the gold-to-silver ration looked like

Since 1687 – as far back as the record reaches – the ratio of gold to silver fluctuated between about 14 and 100. Around 1900, the ratio was stable and remained relatively flat.

Before 1900, the ratio of gold to silver actually fluctuated around 16. This was probably due to the fact that many countries used gold and silver backed currencies. For example, France and the United States (among others) imposed statutory limits on what the relationship could be.

The US Geological Survey also estimates that there is 17.5 times more silver in the earth’s crust than gold, which may provide further explanation for the relationship between gold and silver before 1900.

Throughout the 20th century, however, the ratio of gold to silver has averaged about 47-50 and has sometimes fluctuated wildly.

What does this mean for the future?

Some experts predict that the ratio of gold to silver will return to the long-term average before 1900 of 16 to 1. Many factors are mentioned in this favorable statement. It is worth noting, however, among these experts are some of the most ardent advocates of silver investing.

In the end, for the ratio to return to the average before 1900, the price of silver would have to rise to about $ 105 per ounce. Similarly, if the ratio were to fall to the long-term average, silver prices would rise to about $ 61 per ounce. The ratio of gold to silver is really one of several valuable tools used to determine the optimal time to buy gold or silver.

However, it is wise to avoid urgency. Only the most experienced investors make profits with a short-term view, and they too get misjudgments. With patience, research and a long-term vision, you can choose to buy silver when the ratio is high – buy higher quantities with fewer dollars.

What affects the silver price?

As with all raw materials, the price of silver varies based on the relationship between supply and demand. However, silver is relatively unique among precious metals, as supply is relatively static and demand does not decrease when the price rises. Despite historical volatility, the value of silver has increased more than any other precious metal since 2002, and experts expect the price to continue to rise.

Industrial demand

Unlike gold, platinum and other precious metals, industrial demand accounts for more than half of the total demand for silver. Manufacturers use silver in many high-tech devices such as mobile phones and flat-screen TVs, and its unique properties mean that other metals cannot be used instead. The small number of silver mines that are active globally means that supply cannot be significantly increased in response to demand. As demand increases while supply remains static, experts predict the price of silver will continue to rise.

Medical demand

The electronics industry alone does not account for the entire demand for silver. The metal is used in many high-tech medical devices, and researchers are finding increasing uses for silver in pharmaceuticals due to the biocidal properties of the metal. As an antibacterial and antimicrobial metal, hospitals and other medical facilities are exploring the use of silver as a disinfectant. These special properties of silver continue to drive demand for the metal and affect its price.

Investment demand

While the gold price is largely driven by investment demand, as investors see it as a hedge against inflation. Silver’s volatile market meant that it was previously used more to make a quick return than as an investment to maintain wealth. But the industry’s need for silver at any cost has made the metal more attractive as a long-term investment. Declining amounts of silver have led investors to store the precious metal, especially as many are trying to diversify their portfolios by holding hard assets.

Political climate

When political events cause global uncertainty and economic instability, investors turn to precious metals to protect their wealth against the volatility of global financial markets. Especially with silver, prices can be affected by a choke in the supply if the natural resources in countries that mine the metal are nationalized. In addition to these factors, increases in the gross domestic product of the industrialized countries lead to an increasing demand for consumer electronics and other manufactured goods that use silver in their production, leading to a corresponding increase in the demand for the metal, which drives up its price.

Short and long term levels for silver?

Silver took over the 20 EMA and tests the next resistance at $ 25.55 Silver witnessed some sales on the last trading day of the week and erased a large portion of the previous day’s gains to over two week highs. XAG / USD was last seen trading around $ 25.15-20, down 1.05% for the day.

The latest bounce from YTD declines that hit March 31 stayed close to the $ 25.60 confluence region. The said barrier consisted of the 61.8% Fibonacci level of the $ 26.64- $ 23.78 decline and the upper end of a short-term rising channel. This should now serve as a crucial point for short-term traders and help determine the next part of a targeted movement for XAG / USD.

The white metal has so far shown a certain resistance below 50% Fibo. level and managed to keep his neck above the psychological mark of $ 25.00. The level coincides with the trend channel support, which, if broken, can trigger certain technical sales. This in turn will create the stage for an image against testing 38.2% Fibonacci. level, around the region $ 24.85.

Meanwhile, technical indicators on hourly charts have once again begun to slide into negative territory. In addition, oscillators on the daily chart have not yet recovered from the bearish zone. The plan supports the prospects for a possible break against the disadvantage and the resumption of the previously / well-established downhill course that has been experienced during the past two months.

The next relevant bearish target is tied near the $ 24.45, or 23.6% Fibonacci level. Some follow-up sales will lift all short-term positive prejudices and turn the XAG / USD vulnerable to accelerate the fall to the $ 24.00 round figure. The driving force can be further extended and withdraw the product towards YTD locations, around the region 23.80-75 dollars.

On the flip side, the $ 25.60 region may continue to act as immediate strong resistance, covering the upside for XAG / USD. With that said, a sustained pull beyond can lead to a new short-coverage pull and help the metal aim back to regain $ 26.00. Each subsequent promotion would allow bulls to challenge the $ 26.40-50 heavy supply zone.

Weak dollars provide support for silver

Silver is currently trying to overcome the resistance to $ 25.55 while the US dollar is losing ground against a broad basket of currencies. The US Dollar Index has finally managed to settle below support at 20 EMA at 92.35 and is trying to settle below the next support at 92.15. if the US dollar index falls below the support at 92.15, it will go towards the 92 level which will be bullish for the silver and gold price today. Weak dollar is a bullish catalyst for precious metals as it makes them cheaper for buyers who have other currencies.