JPY in Real Time: Live Rates for Japanese Yen

The Japanese yen is the world’s third most traded currency and, together with the USD, is the second most traded currency pair in the entire forex market; USD / JPY. Here you will find interesting facts about the currency’s background, its status on the world market, the basics of Japan’s economy and tips on how and where to best trade JPY. Please enjoy!

USD/JPY

EUR/JPY

CAD/JPY

AUD/JPY

Table of Contents: Overview

Background facts about Yen

The Japanese yen is the official currency of the Japanese empire, and has been since its introduction in 1871 under the rule of the Meiji government. The currency is issued by the Bank of Japan (BOJ), headquartered in Tokyo.

Before the yen, the Mon currency dominated, which was based on a complex monetary system that was used for more than 500 years. The Spanish silver dollar also circulated extensively in Japan, as well as elsewhere in Southeast Asia and along the Chinese coastline. The Spanish coins reached the Asian continent by ship over a period of a couple of hundred years, and were for a long time an obvious means of payment for many countries in Southeast Asia – including Japan.

When the new currency was finally introduced, it was given the name yen, which means circle in Japanese. In Japanese, the name of the currency is pronounced as one, so the spelling with a y at the beginning may seem somewhat misleading. However, the yen is a globally accepted term used across large parts of the world.

ISO 4217 code is JPY, and Japan is the only country in which the yen is the official currency. For more useful information on trading with the yen, we at ForexTrading.uk have created an in-depth article on the subject.

A Major Economic Power – But Weak Growth Lately

Despite the country’s modest size, Japan is still classified as an economic power and was for a long time the country that after the United States was estimated to have the world’s second largest economy. In 2010, however, the country was overtaken by China, but the economic power status remains. The country has limited natural resources and is dependent on importing essential commodities such as aluminum, bauxite, iron ore and energy resources such as oil and natural gas. Instead, the economic strength lies in the extensive manufacturing industry, in which Japan is a world leader in many areas. The manufacturing industry – dominated by textiles, cars and electronics, among other things – has been crucial to Japan’s economic progress – the so-called Japanese miracle. The main and most important trading partners are still the USA and China.

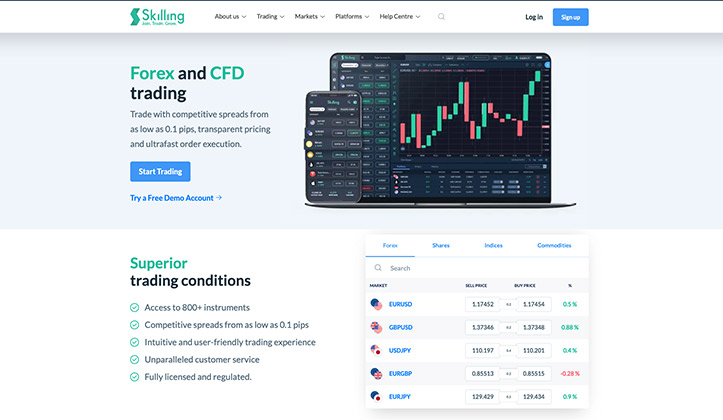

Rating: 9.56/10

Minimum deposit: 100 GBP

Description: Trade, investor or speculate in JPY at Skilling – one of the most transparent and innovative forex brokers. Get started with a demo account now!

Risk warning: 76% of retail investor accounts lose money.

Despite strong financial conditions, the Japanese currency has been hit by a number of significant crises over the years – with a fall in the exchange rate and a sharp weakening as a result. World War II hit hard on the value of the JPY, which between 1941 and 1949 was so weak that there was not even a real exchange rate. In an attempt to stabilise, the yen, as part of the Bretton Wood system, was set by the United States at 360 yen per $ 1 – a rate that persisted for many years. US aid had a very good effect on Japan’s economy, which recovered with notice and grew at a record pace until the early 1990s, when a major crash, mainly in the banking and construction sector, had dire consequences and the economy fell again.

Over the years, currency and economic setbacks have driven down interest rates as well as inflation and growth in the country. Central government debt last year amounted to as much as 237.1% of the country’s total GDP, while gross domestic product was only a modest 0.8% and inflation at 1.0% – which is still a positive development from the deflation the country was dragged with for a long time. The policy rate is very low and has been so for several decades.

Forex trading with JPY

As previously mentioned, the JPY is one of the most traded currencies in the entire forex market, beaten only by USD and EUR. In other words, the interest is great, despite the currency’s tough challenges. Due to the country’s extremely low interest rates, the currency is particularly popular for so-called carry trading – a strategy in which you take advantage of interest rate differences between different currencies and thus can go plus on a positive interest return. For carry trading, for example, TRY/JPY or RUB/JPY may be suitable alternatives, but since the TRY is in more or less free fall at the moment it might be a good time to wait a bit more with that currency pair for carry trading. USD/JPY is the most traded pair overall, but also EUR/JPY, CAD/JPY, GBP/JPY, CHF/JPY and several others are hot with many forex brokers. If you want to trade JPY, Scandinavian Skilling is one of the platforms with the widest range of JPY pairs, in addition to very competitive spreads and record-breaking executions. Sign up with BankID and get started with currency trading quickly, easily and smoothly.

What is the Best Time to Trade the Yen?

Since Japan is 8 hours ahead of the United Kingdom, the most favorable time to trade the Japanese yen is late night / early morning and morning (GMT). Then the time around noon is local time, trading is in full swing and you can take advantage of extensive trading volumes. Tips and updated news about forex trading with both JPY and other currencies can always be found here at ForexTrading.uk.

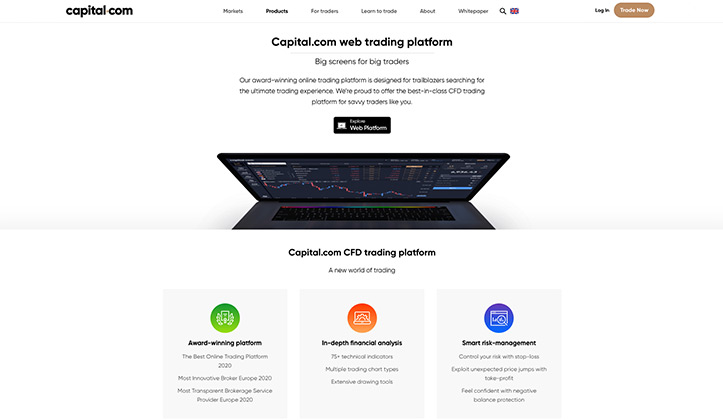

Rating: 9.67/10

Minimum deposit: 250 GBP

Description: Amazing amount of currency pairs with the Yen. Trade with a fantastic platform and flexible leverage. Try Capital today!

Risk warning: 75.26% of retail investor accounts lose money when trading with Capital.