NOK Live Rates: Norwegian krone in real time

Here at Forex Trading you’ll find information about the Norwegian krone, where it can be traded and how real-time exchange rates of for EUR to NOK or USD to NOK are in real time. ForexTrading.uk discusses what the exchange rates below mean, where you can trade NOK, discusses a bit about the outlook for NOK this year and explains why Norway’s currency is partly a bet on oil.

EUR/NOK

USD/NOK

NOK/SEK

Table of Contents: Overview

- 1 What does the above live rates mean?

- 2 Norwegian krone: A bet on oil?

- 3 Where can I trade the Norwegian krone?

- 4 Why do Skilling offer so many Norwegian currency pairs?

- 5 Can the extremely large foreign exchange reserve be a problem?

- 6 What is the outlook for NOK?

- 7 What speaks for the Norwegian krone?

- 8 What speaks against the Norwegian krone?

What does the above live rates mean?

You always start from the back when you read out how much to pay for a currency. So in the first live exchange rate (EUR/NOK), this means that you have to pay just over 9.8 Norwegian kroner for 1 Euro. In the second live exchange rate, it is USD/NOK that is measured. At present, more than 8.5 Norwegian kroner is required to exchange for one US dollar (USD).

For most of the last 10 years, the Norwegian krone has been considerably stronger than the Swedish krona, with exception for 2020-2021. For the third Norwegian live exchange rate, the Norwegian krona is now the strongest one. For around 1 Norwegian krone, you get 1.01 Swedish krona.

Norwegian krone: A bet on oil?

Today, a number of factors are addressed that affect the relative exchange rate of Norwegian kroner. We have oil expert Erik Forsell to help us.

There are about 50 factors that can affect exchange rates. Some of these are inflation, interest rates, the balance of payments, the central government debt, the trade balance, economic development and political stability. Trade between countries and speculation, as well as technical analysis, are other factors that also affect currencies.

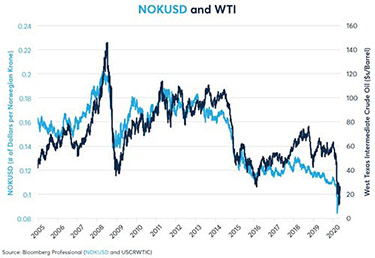

From the perspective of the US dollar (USD), the Norwegian krone (NOK) seems to be driven by two main factors apart from the above mentioned ones:

The oil price and the relative value of other European currencies.

NOK/USD and WTI

This is not so surprising given that crude oil and its refined products account for 30.5 percent of Norway’s exports, and natural gas accounts for another 26 percent. Over 75% of total exports went to Europe (4% to Denmark, 8.5% to Sweden, 20% to the United Kingdom and 43% to the euro area).

Where can I trade the Norwegian krone?

When planning to enjoy forex trading with Norwegian kroner, Skilling (read the independent review) has the best offer. You can trade EUR/NOK, GBP/NOK, USD/NOK, SEK/NOK, AUD/NOK, CAD/NOK there. They also have the fastest closing for trading and the lowest spread for the Norwegian krone. Try a demo account at Skilling now!

Why do Skilling offer so many Norwegian currency pairs?

Well, Skilling Group’s former CEO and one of the largest owners likes currency trading. His name is André Lavold and he is an entrepreneur who founded several companies and invested in many others through Optimizer Invest. There are not many forex brokers who have a really good range, spread and opportunities to trade Norwegian kroner. So in our view, there is no reason to trade anywhere else. The people behind ForexTrading.uk have been trading currencies with CFDs for over 15 years.

Rating: 9.78/10

Minimum deposit: 50 GBP

Description: Handla norska kronor hos Skilling, Sveriges snabbaste online tradingäklare 2020. Kom igång med trading på under 1 minut med BankID!

Risk warning: 68% of private investors lose money when they trade CFDs with eToro.

Can the extremely large foreign exchange reserve be a problem?

Norway has foreign assets worth 560 billion US dollar, which is both a strength but the foreign exchange reserve can also be a problem. If this capital is repatriated to Norway, it will provide support for the Norwegian krone. However, it would also lead to the Norwegian krone being overvalued against its peers. The latter would damage the economic competitiveness of Norway’s already underdeveloped industrial sector. Using the foreign exchange reserve to support government spending could thus support economic activity in the short term but can strengthen the currency, making it more difficult for Norway to develop other sources of growth in addition to natural resources.

Norway’s private debt is another story. The household debt ratio is high, and it amounts to 100 percent of Norway’s GDP. Corporate indebtedness is also high, corresponding to 132 percent of the country’s GDP. Now, however, GDP may not be the best measure of corporate indebtedness, as some of this debt is supported by corporate income outside Norway.

This means that some of Norway’s households and companies may have problems paying their debts, even though their financial position is probably less exposed than that of companies and households elsewhere in Europe or the USA.

What is the outlook for NOK?

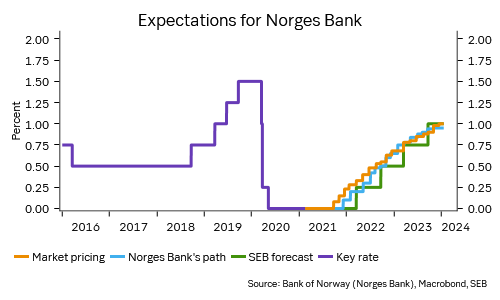

Many analysts have different opinions about the Norwegian krone, but much also depends on how Norges Bank (the central bank in Norway) acts. They were one of the first central banks in Western Europe to raise the interest rates, to handle the rising inflation while the unemployment rate remains low and house prices been raising drastically. Expectations among most analysts is that the NOK will continue to strengthen, especially if the oil price continue to do so as well.

What speaks for the Norwegian krone?

+ A rising oil price strongly supports NOK.

+ The country has managed Covid-19 better than most other European countries.

+ Low unemployment that does not increase much further, which was discussed in the article on USD / NOK.

+ Looks like Norway are raising interest rates earlier than many other countries.

+ The trend is positive for NOK right now, but everything can fluctuate – so keep an eye out for support and resistance levels as well as macro data for Norway.

What speaks against the Norwegian krone?

-Reduced risk appetite: Increased global risk would be negative for the Norwegian krone, as investors often flee smaller currencies during such time periods.

-If oil falls, it is a negative factor for the Norwegian krone, as people withdraw money from oil shares or oil funds, which means that they sell Norwegian kroner and exchange into their local currency.

-It has really progressed for a number of months now.

-When people sell shares from the Norwegian market, NOK tends to lose value.

Which live rate for NOK is missing? Let us know and we’ll do our best in order to add that currency pair too!