Mastercard as a deposit method

Mastercard is one of the two most established card payments in the world, with VISA as the main competitor. With the help of Mastercard, you can handle deposits without cash. Invaluable.

Table of Contents: Overview

6 brokers offer Mastercard

Mastercard is an American payment service that handles payments between banks and individuals who use their card. Discover and experience currency brokers with Mastercard. Priceless.

Below we list the Mastercard brokers we recommend with the highest rating first.

Short facts

How fast can a Mastercard payment be made? If you have the card saved in your browser or on your mobile, it will take a few seconds. If you enter the entire card number, it usually takes about 40 seconds.

From which country does Mastercard come? U.S.

How do I contact Mastercard? You should contact your card issuer directly from answers about your specific credit card. However, the general number is 0800-96-4767.

Email: [email protected] – however, it’s often a good idea to contact your own bank first since they will be responsible for most services directly to you.

Available to customers from: Worldwide

Number of employees: About 14 000.

Official website: https://www.mastercard.co.uk.

4 easy steps to Mastercard payments

You get started really easily.

1. First select a currency broker.

Decide how much you want to deposit.

Click on Mastercard as the payment option.

Deposit money and you’re good to go.

Has always been called Mastercard?

No, initially it was called Interbank, between 1966 and 1969 to be exact. Then they changed their name to “Master Change” between the years 1969 to 1979. Mastercard Inc has been called “MasterCard” from 1979 to 2016 and nowadays only small letters are used and it is printed as a mastercard instead. We guess that the latest name changed help to make this a memorable card that most bank customers are aware of.

How do I get a Mastercard in the UK?

If you already have a UK bank, it’s easiest to just ask your own bank.

If you are dissatisfied with the current bank and want a Mastercard from another issuer, then check out the list of UK card issuers at Mastercard.co.uk.

It’s just Revolut that they do not mention, which can also be a good option for you who want a flexible Mastercard without being tied to a particular bank. With Revolut, with the “black” card in metal, you also get access to lounges at a one-time cost (only when used), but the first two lounge visits are free. Revolut’s black Mastercard costs only 14 GBP per month and offers real benefits, such as 1% cashback on everything you buy, travel insurance, 30 currencies in one account, free EURO-iban account, etc. Apply for a Revolt card online and get an online card in 1 minute or your physical card within a few days.

Advantages

+ Does not need to have a separate Bitcoin wallet. Priceless.

+ There are some things that money can not buy. For everything else, there is Mastercard.

+ Helps you find profits in new places.

Disadvantages

-Some banks charge a fee every year for you to have a Mastercard, especially the slightly “nicer” and more rewarding cards.

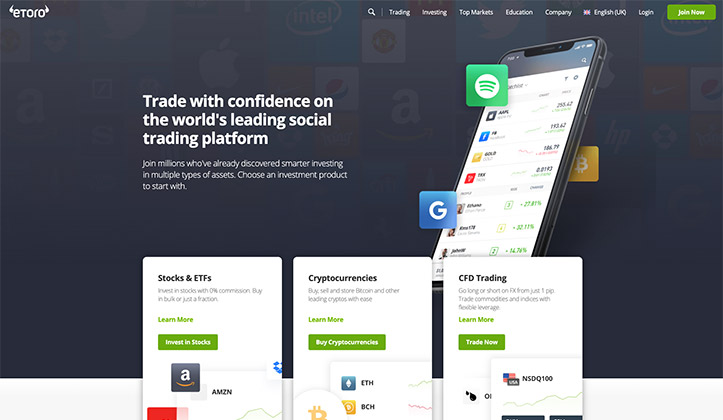

Rating: 9.78/10

Minimum deposit: 50 GBP

Description: The highest ranked forex broker supporting Mastercard transfers.

Risk warning: 68% of private investors lose money when they trade CFDs with eToro.