eToro: From forex trading start-up to NASDAQ through a SPAC

The world’s leading online trading broker for copytrading, soon looks set to take the step onto the US stock market with a listing on NASDAQ. ForexTrading.uk can report that at the time of writing the company is undergoing a merger with the SPAC company FinTech Acquisition Corp. V and the entire deal is expected to be completed in the autumn of 2021.

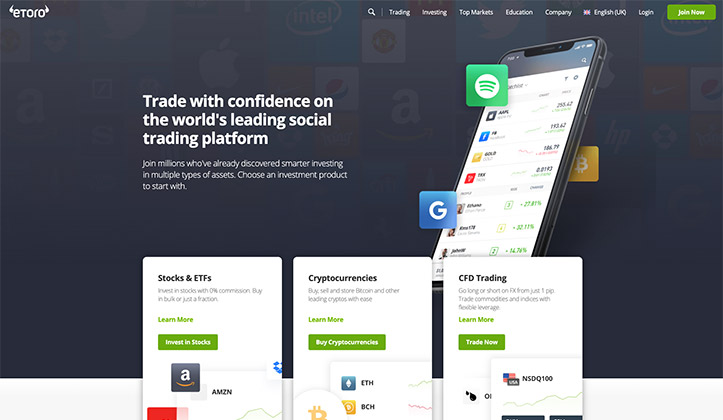

For many years, the Israeli founded company eToro Ltd has successfully operated what has become the global trading market’s largest brokerage platform for so-called copy trading – or social trading. The extremely flexible leverage is also something that makes eToro different from the crowd, which means that with both currency trading, stocks, commodities, indices and cryptocurrencies, you can adjust your leverage level from completely without leverage to a real leverage.

Table of Contents: Overview

This is how eToro was founded

Brothers Yoni Assia and Ronen Assia saw opportunities in online trading and took the step of creating the company RetailFX together with David Ring. eToro as it was later called, was founded in Tel Aviv at the end of 2006 and today can boast millions of registered users worldwide. A merit that not only makes eToro the largest in copy trading, but also in online trading in general.

The goal has always been that currency trading should be easy and accessible to everyone, no matter where you live. In 2010, eToro’s first social trading platform called “Open Book” was released. The name today is eToro copy trader which we reviewed in detail and you can also read more in detail about how it can be used in both ups and downs. On several occasions, eToro raised money; first SEK 270 million in 2007-2013 and then another $ 27 million in 2014. In 2018, another $ 100 million was raised during another round. eToro’s first app was released in 2012, which means that it has been around for just over 9 years now.

The size and growth opportunities lead to Nasdaq

Despite the successes, the company behind the site has so far made no attempt to step into the stock market and become a public company. Until now. One of this summer’s most exciting news in the online trading market is eToro’s ongoing negotiations for a merger with FinTech Acquisition Corp. V – a so-called SPAC company with both a large bag of money and expertise in finance and tech to contribute. The merger and listing is expected to be completed sometime during the third quarter of 2021, after which fans of eToro as a platform can not only use the site for their trading – but also invest and take part in the company’s continued success.

SPACs is one of the hottest business trends in 2021

SPAC is an acronym for Special Purpose Acquisition Company, which in turn is a company that, in connection with being listed on a stock exchange, raises capital from investors. The money invested in the company is then used to buy or – as in the case of eToro and FinTech Acquisition Corp. V – merged with another, still unlisted company. In connection with a SPAC being listed on the stock exchange and raising capital, it is given a specific deadline, within which they must have completed a company acquisition with the help of the invested money.

When the acquisition is then completed, the acquired company through the SPAC is automatically listed on the stock exchange and the SPAC changes in connection with that name. In this case, eToro Group Ltd will be the new listed company – the final result of the transaction between FinTech Acquisition Corp. V and eToro Ltd.

A SPAC offers favorable opportunities for both unlisted companies and investors. For unlisted companies, an acquisition of or a merger with a SPAC will be a much easier way into the stock market than in a traditional procedure. By merging eToro with a company already listed on NASDAQ, eToro itself will automatically become a public company listed on NASDAQ. For investors, an investment in a SPAC means a chance to be involved in an hopefully successful, forthcoming IPO at an early stage.

Become part of a global trading network – registrera dig hos eToro redan idag.

Rating: 9.78/10

Minimum deposit: 50 GBP

Description: Discover the leading online trading broker for copy trading. Register at eToro today!

Risk warning: 68% of private investors lose money when they trade CFDs with eToro.

eToro + FinTech Acquisition Corp. V – a perfect match?

FinTech Acquisition Corp. V is far from the only SPAC company in the American – or for that matter the global – market. Already halfway into 2021, more SPAC companies have been registered on the US stock exchanges than during the whole of last year. In other words, the company form is hotter than the hottest right now.

Of all the SPAC companies that have emerged recently, however, FinTech Acquisition Corp. Be an excellent partner for eToro to team up with. The company was founded in 2019 and has since its inception been particularly focused on modern and innovative technology in trading and finance. The chairman of the board is Betsy Z. Cohen – an experienced board fox with solid expertise in fintech and who has previously founded and been CEO of the global finance and tech company The Bancorp.

With FinTech Acquisition Corp. V’s specialty in just fintech and its several previously successful deals of the same type as this one with eToro, this particular SPAC company is probably the best match for eToro’s path to the stock market. The company went public in December 2020 when it was listed on NASDAQ, with a total of USD 250,000,000 in invested capital for future acquisitions.

What does the Nasdaq listing mean for eToro’s customers??

eToro’s transformation from a private to a public company means, above all, significantly better transparency and transparency of the business’s finances. eToro is already in its current private company form one of the most reputable and serious brokers on the market, which is why transparency is not really a problem. The requirements for transparency that come with a stock exchange listing nevertheless always mean security for you who use eToro as a broker.

Furthermore, the listing can also be expected to breathe even more life into an already successful and popular platform. With new capital and new investors, eToro Group Ltd can take the business to new heights and offer customers even better services and an even more qualitative trading experience. Finally, it is of course also exciting that you will soon be able to buy shares in one of the world’s leading online brokers.

Why choose eToro as an online broker?

t is not for nothing that millions of traders around the world – at all levels – choose to trade currencies, stocks, indices, commodities and ETFs with eToro. Not least when it comes to copytrading. At eToro, there is a fantastic community of connected traders, with whom you can both share and copy strategies and thus both give and get inspiration in your trading. Copytrading is an excellent way to get a foothold in the market if you are a beginner, but also to automate your trading and make it both more convenient and less risky. By copying other successful traders, you will likely reduce the risk of making ill-considered and impulsive trading decisions yourself.

Furthermore, eToro is an UK-regulated broker as well as the one of all platforms that offers the most flexible leverage. The highest leverage level is at 1:30 according to current UK regulations, but here you can adjust to the level you want or if you want to trade completely without leverage. Narrow spreads, intuitive and lightning-fast software and a website entirely in Swedish are additional qualities that attract.

Discover one of the market’s best brokers too – become a customer of eToro today!

We at ForexTrading.uk look forward with excitement to the merger between eToro Ltd and FinTech Acquisition Corp. V must be approved by the US SEC and that a new listed trading company sees the light of day sometime during Q3 2021 – eToro Group Ltd.

What do you think about eToro’s prospects as a listed company? Will you invest in the autumn or do you choose to wait?

Discover one of the best brokers on the market too – become a customer at eToro today!

Rating: 9.78/10

Minimum deposit: 50 GBP

Description: Try the king of copy trading with currencies, shares and indices with CFDs. Register at eToro today!

Risk warning: 68% of private investors lose money when they trade CFDs with eToro.

Published:

Author: Emelie Rubenson

TAGGAR

Other similar news

Below you can see more similar news if you want to learn more about this subject or find related topics.Everybody knows there's a war going on in Ukraine, Russia is trying to take over the country and the...

Recently we've seen headlines all across the globe shouting about how Russia is preparing to invade ...

It's been roughly 2 years since the start of the Corona pandemic, one of the biggest events in moder...