Can I start trading today at Skilling if the deposit is made now?

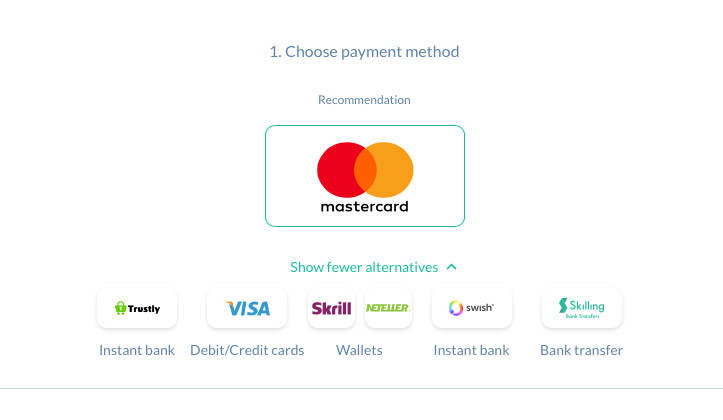

Forex trading often gets questions about how fast it is possible to start trading online, from the time you open an account and make a first deposit. The simple answer? It depends on which deposit method you choose. With a VISA card or Mastercard, it normally only takes less than 30 seconds.

Many forex brokers emphasise how fast it is possible to open an account and get started trading with them – but how quick is really “fast”? Is it seconds, a minute, a few hours or maybe even a couple of days? It all depends a lot on which payment method you choose to make a deposit with, and if you have been approved to trade, which means verified your ID and address.

With some deposit options, the transaction takes place immediately, while others allow you to wait a couple of days. If you want to be sure of being able to start trading as quickly as possible, it is therefore important to choose the right type of deposit method. Let’s look at what the most common options are.

Table of Contents: Overview

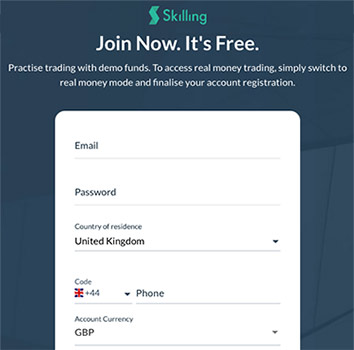

Registration in 10-15 seconds

To get started with forex trading, it is important that the registration goes quickly. At sites like the popular Skilling, it does not take more than 10 to 15 seconds to start and create an account. All you need to fill in is your name, email and mobile number. Nothing else. Then it’s all done and you have nothing more to handle.

You can practice trading with a demo account. If you want to complete the registration, adding proof of ID and address is required, which, as you probably know, is fairly quick. But what you need to do first of all is register, which is probably the easiest process among all forex brokers reviewed on ForexTrading.uk. What are you waiting for?

VISA or Mastercard?

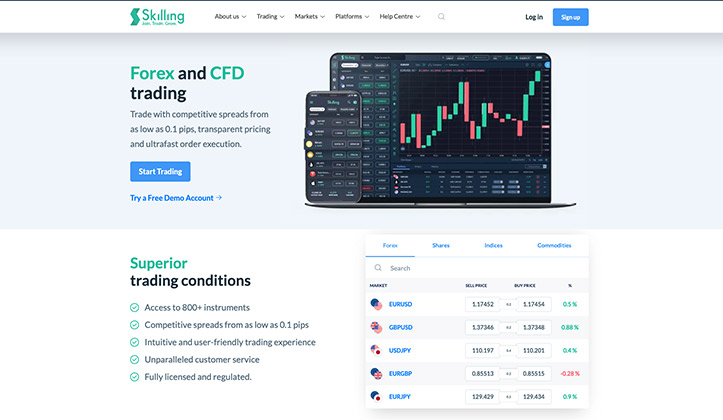

The majority of all currency brokers offer card payment as an optional deposit option. VISA and Mastercard are the most commonly used card types, while American Express and Diners Club are rarely used.

The advantages of using a bank or credit card are that the transactions take place immediately – which thus means that you can get started with your trading at once – but also that card payments are simple. The vast majority are familiar with bank and / or credit cards, have several different ones in their wallets and have made payments online with cards before. The threshold is low, which is why the method is very fast and flexible.

A small monkey can be the possible fee that the card company charges in connection with a payment. Most brokers offer completely free deposits, but whether the card company charges a fee, they can not control. Thus, it is important to check any surcharges from VISA or Mastercard, even if the service at the broker is free. Fortunately, these are seldom large sums, but only a few percent of the amount deposited.

Rating: 9.56/10

Minimum deposit: 100 GBP

Description: At Skilling, you can make deposits with Swish, credit cards, digital wallets or bank transfer. Fast, smooth and secure. Try Skilling, you too!

Risk warning: 63% of retail investor accounts lose money.

BACS and Traditional Bank Transfers

Like card payments, there is also bank transfer as an option with almost all brokers. The method is perhaps the least modern at this point, but still one that is still widely used. The security is high, but if you are eager to get started, it is good to know the average transaction times for the bank you use before making a transfer. It can go fast, even in just a few minutes, but it is not uncommon for it to take a couple of banking days before the money arrives. For bigger deposits, above 5000 quid, it’s the most common payment methods.

Register with Skilling and get started with forex trading in no time.

Swish – The fastest method?

Swish has had a huge impact in recent years thanks to the simplicity of being able to pay directly with your smartphone. The payment service is still growing so fast and is now not only accepted at smaller brokers, but also in large retail chains, online and at some currency brokers. As the service is Swedish, it is mainly available as a payment alternative at Scandinavian brokers. We are hoping and expecting that Swish might be introduced in the UK within 2 years.

Popular Skilling is, for example, one of the sites that support the service. Try a quick deposit with Swish today if you live outside the UK.

Poorer availability at international brokers is a bit swish in the barrel, but the speed is on the other hand unbeatable. If you make a deposit with Swish, the money will be visible in your trading account immediately. The service is also considered one of the safest ways to make payments and transfers online.

Skilling: Start trading in 3 minutes, get money out within 24 hours

Another common question is how long you have to wait to get your money out in connection with a win. If you make a profit on a trade, the profit is first visible on your trading account, after which you must request a withdrawal to have them transferred to your bank account.

How long it takes to get money out can vary between different brokers, but you should not have to wait more than a maximum of a couple of days. Here, too, Scandinavian Skilling is at the forefront. After withdrawal, you have your money in just 24 hours, which is among the fastest transaction times at market. You can open an account at Skilling and try currency trading in a fun and simply manner.

Unlike deposits, withdrawals are not always free from the broker. The conditions can look very different for different platforms, which is why it is important to read the fine print before opening an account with someone. Some brokers offer a certain number of free withdrawals – for example, the first five or a certain number per year. Others set fees based on amount limits and then there are those who offer 100% free withdrawals all the time. The latter is of course the most advantageous, and also something that is becoming more and more common with more and more brokers. Free deposits and withdrawals are almost as important for traders as tight spreads and low (or preferably no) commission. The demand for generous terms is high and the competition between brokers is great, which is why the range of platforms with free withdrawals is also increasing. Fortunately, withdrawals are free at Skilling.

Rating: 9.56/10

Minimum deposit: 100 GBP

Description: At Skilling, you can get started in less than 30 seconds with an amazing platform. What are you waiting for? Create your risk free demo account now!

Risk warning: 63% of retail investor accounts lose money.

Conclusion – Can you trade currency on the same day as the deposit?

It is entirely possible – but it depends on which payment method you choose. If you make a transfer of 2000, 5000 or 10,000 GBO (or any other amount) with a method such as Trustly or credit card, the money will be available in just a few seconds and it is thus free to start trading. However, this applies provided that all other steps in your account verification are completed and approved. If you have initially tested yourself with a demo account, you must first and foremost switch to a real live account with a real balance to be able to trade.

Modern platforms, better security and above all payment services based on more advanced technology have meant that online trading in recent years has taken a big step forward in terms of speed and flexibility, not least in terms of capital transfers. The opportunities are greater today than ever before – so even for the most impatient trader.

Published:

Author: Emelie Rubenson

TAGGAR

Other similar news

Below you can see more similar news if you want to learn more about this subject or find related topics.Everybody knows there's a war going on in Ukraine, Russia is trying to take over the country and the...

Recently we've seen headlines all across the globe shouting about how Russia is preparing to invade ...

It's been roughly 2 years since the start of the Corona pandemic, one of the biggest events in moder...