Norway will discuss interest rates on Thursday, what should we expect?

On Thursday, 16th December the central bank of Norway, also called Norges Bank will discuss what to do with the interest rates.

Recently there’s been a new wave of Corona infected patients which made the government take immediate action and impose restrictions to keep the country from spreading the virus further. They also expect Norway to become a country leading in the number of Omikron infected patients, which is the new variant of Corona that has recently been discovered. We still haven’t gathered enough information about this new variant but the government of Norway won’t take any risks, therefore a rise in interest rate which has been planned for a long time might take longer because of this. So how should you prepare for this meeting as a trader?

Will they raise the interest rates or not?

The plan is to keep the rates low until we reach full employment, that’s has been the plan ever since the start of this pandemic in the United States. Chairman of the Fed, Jerome Powell has continuously said that rates won’t be raised until the economy is back to where it was before the pandemic. This is important because many countries tend to follow in the same direction as the United States when it comes to economic policy. Many are speculating when the federal reserve will raise the interest rate, mainly because it will cause the stock market to correct itself but also because in the past they’ve raised the rates to slow down inflation. But even with the recent spike of inflation, the Fed has decided not to raise interest rates yet. And they’re planning on continuing to keep the rates low for some time, JP Morgan estimates that the Fed will start to raise the rates around September 2022 according to Reuters.

Earlier this year, the federal reserves repo investments surged to a record of 756 billion dollars, which is the highest it has ever been according to the Wall Street Journal. This is very concerning since the feds repo rates stand at a standard rate of 0.05% which is very low, even lower than the private market. So why do banks and other institutions park their money someplace where they earn so little? Well, this is not a surprise. Every time there’s some sort of concern for inflation financial institutions tends to put their money into the bond market because it’s safer. By having put their money into repo rates the banks are guaranteed an income, even if it’s very small they firmly believe the reward is greater than the risk of putting the money into the private sector.

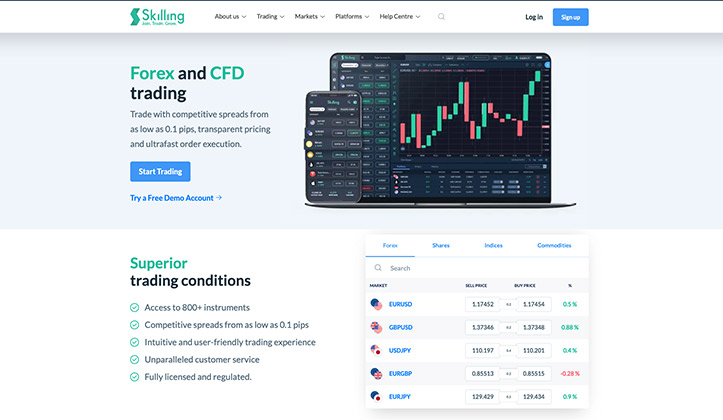

Inflation is an important measurement of where the economy is heading because it will precisely tell how people and institutions will behave in the future. The main driver of inflation is demand, however, the federal reserve can artificially increase demand in the market by buying up bonds which causes asset classes and prices to rise. A great example of this phenomenon is Australia, currently struggling with tapering and rising prices. If you are looking to trade with the Norwegian krona, then try Skilling (review), since they got most pairs, are Scandinavian themselves and have an amazing platform that’s very user friendly and intuitive.

Rating: 9.56/10

Minimum deposit: 100 GBP

Description: Skilling was founded by Scandinavians, and one of them are from Norway. He required that over 10 currency pairs with NOK should be featured. Try Skilling now!

Risk warning: 63% of retail investor accounts lose money.

Inflation could be your friend, also your enemy

Back to Norway, why this is important specifically to Norway is the fact that they’re one of the biggest exporters of energy and foods which are the two items that have the highest value on the trade sheets. Any significant changes in the Norwegian krone might cause prices to go up or down, depending on what policy is being put into place. This also creates a lot of opportunities you can prepare yourself for regardless of what type of trader you are.

If they decide to raise the rates, which would be the historically relevant decision for this type of moment then you need to be careful as to where you put your money. The forex market will become volatile, however, since Norway exports more than they import ensuring your money in the Norwegian krone might be a good idea to secure yourself against devaluation. If you want a great example of how you can utilize this type of situation, article about the British pound.

If they decide to not raise the interest rates, well that’s where you should start looking into alternative options. The problem is that since we’ve never encountered this type of economy where the central bank never raises the rates during inflationary times we can’t predict which way the market might go. This is why alternative asset classes might come in handy, especially in commodities. One of the best commodities to trade during unclear times is the different types of oil in the market, mostly because demand will never go away but also because of the technological revolution we have right now the energy demand will keep going up during the coming years. Oil is still very essential even if sustainability is the center of attention.

Other commodities that are used for industrial innovation will also be very relevant in the coming years, silver is a very classic asset class to trade but other commodities like copper and gold will be in high demand during the coming years.

Where can you trade a large variety of asset classes?

Skilling (review) – Skilling is one of the most reliable brokers on the market right now, it’s a Cyprus-based company with a background of Swedish entrepreneurs. The platform is also very user-friendly, regardless of whether you’re an intermediate or a beginner this platform will really make trading easier for you. Click here to start trading here!

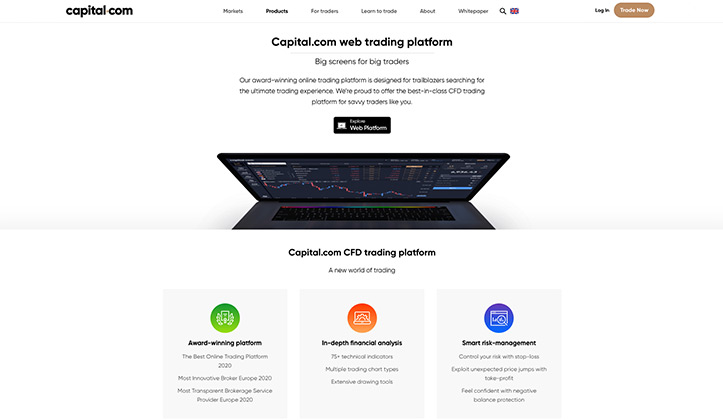

Rating: 9.67/10

Minimum deposit: 250 GBP

Description: Trade more than 50 commodities, 1000’s of shares and forex CFDs. Try Capital with our without leverage now!

Risk warning: 75.26% of retail investor accounts lose money when trading with Capital.

Published:

Author: Robin Babaiy

TAGGAR

Other similar news

Below you can see more similar news if you want to learn more about this subject or find related topics.Everybody knows there's a war going on in Ukraine, Russia is trying to take over the country and the...

Recently we've seen headlines all across the globe shouting about how Russia is preparing to invade ...

It's been roughly 2 years since the start of the Corona pandemic, one of the biggest events in moder...